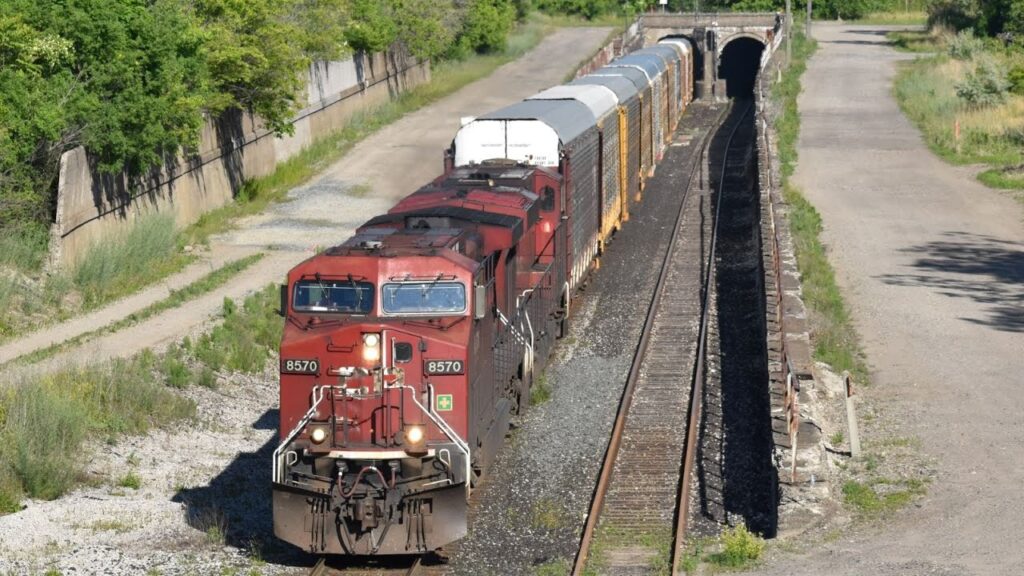

Canadian Pacific Completes Acquisition of Detroit River Rail Tunnel

CALGARY, Dec. 22, 2020 /PRNewswire/ - Canadian Pacific Railroad (NYSE: CP) announced today it has completed its previously announced agreement to purchase an 83.5 percent stake in the Detroit River Rail Tunnel from certain affiliates of OMERS, the…