SÃO PAULO, March 6, 2019 /PRNewswire/ — Azul S.A., “Azul”, (B3: AZUL4, NYSE: AZUL), the largest airline in Brazil by number of cities served and flight departures, announces today its preliminary traffic results for February 2019.

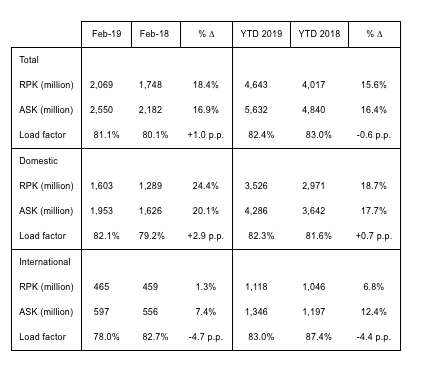

Consolidated passenger traffic (RPKs) increased 18.4% compared to February 2018on a capacity increase (ASKs) of 16.9% resulting in a load factor of 81.1%, an increase of 1.0 p.p. compared to the same period in 2018. Domestic load factor was 82.1% and international was 78.0%.

“We had a very strong February with domestic demand growing 24.4% resulting in a load factor of 82.1%, up 2.9 percentage points. We couldn’t be more excited about the results we are seeing from the A320neos. We now have 24 next-generation aircraft in our fleet and will continue to focus on accelerating our fleet transformation plan going forward,” says John Rodgerson, Azul’s CEO.

Year to date we continue to be the most on-time airline in Brazil with 85.6% of flights departing within 15 minutes of departure time, according to FlightStats.

About Azul

Azul S.A. (B3: AZUL4, NYSE: AZUL), the largest airline in Brazil by number of cities served, offers 821 daily flights to 110 destinations. With an operating fleet of 123 aircraft and more than 11,000 crewmembers, the Company has a network of 220 non-stop routes as of December 31, 2018. In 2018, Azul was awarded best airline in Latin America by TripAdvisor Travelers’ Choice and by Kayak’s Flight Hacker Guide, and also best regional carrier in South America for the eighth consecutive time by Skytrax. Azul also ranked as most on-time airline in Brazil in 2018 according to FlightStats. For more information visit www.voeazul.com.br/ir

This traffic release includes estimates and forward-looking statements within the meaning of the U.S. federal securities laws. These estimates and forward-looking statements are based mainly on our current expectations and estimates of future events and trends that affect or June affect our business, financial condition, results of operations, cash flow, liquidity, prospects and the trading price of our preferred shares, including in the form of ADSs. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to many significant risks, uncertainties and assumptions and are made in light of information currently available to us. In addition, in this release, the words “June,” “will,” “estimate,” “anticipate,” “intend,” “expect,” “should” and similar words are intended to identify forward-looking statements. You should not place undue reliance on such statements, which speak only as of the date they were made. Azul is not under the obligation to update publicly or to revise any forward-looking statements after we distribute this press release because of new information, future events or other factors. Our independent public auditors have neither examined nor compiled the forward-looking statements and, accordingly, do not provide any assurance with respect to such statements. In light of the risks and uncertainties described above, the future events and circumstances discussed in this release might not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any investment decision based upon these estimates and forward-looking statements.