(Reuters) – The chief executive of JetBlue Airways Corp, which has made no secret of its desire to expand into transatlantic service, said on Thursday that U.S. and European regulators should review joint ventures that have allowed big airlines to dominate the market.

JetBlue CEO Robin Hayes, speaking at an airline industry event in New York, said consumers were at risk of decades of high fares because of legacy transatlantic partnerships.

JetBlue (JBLU.O), the sixth largest U.S. airline, wants to service Europe from its main hubs in New York, Boston and Fort Lauderdale, Florida, but is concerned about challenges posed by the big three U.S. legacy airlines’ control of important foreign markets through their global alliances.

American Airlines Group Inc (AAL.O), Delta Air Lines Inc (DAL.N) and United Airlines (UAL.O) are each part of a global airline alliance that together control nearly 80 percent of the transatlantic market. The three carriers also have joint ventures with member airlines in Europe that allow them to coordinate prices and schedules and share revenues.

“We believe that regulators should be doing everything they can to make it possible for new players and new models to have a fair shot at competing,” Hayes said.

Hayes believes competition authorities in the United States, the UK and the European Union should force slot divestitures to create a level playing field for new entrants, particularly in the wake of major consolidation among U.S. carriers over the past decade.

For example, since American Airlines forged a commercial tie-up with fellow oneworld alliance member British Airways (ICAG.L) in 2010, it has merged with US Airways to become the world’s largest airline.

Such mergers have made it more difficult for younger, low-fare carriers like JetBlue to access gates and slots – as airport take-off and landing rights are known – at congested airports where the larger airlines dominate.

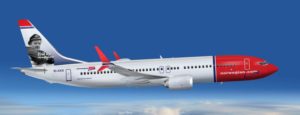

A handful of Europe-based budget carriers, including Norwegian Air (NWC.OL) and WOW Air, have broken into the transatlantic market, but two – Primera Air and Monarch Airlines – were forced into bankruptcy over the past year.

JetBlue argues that Mint, the carrier’s version of business class, has driven a 50 percent decline in premium fares on some competing U.S. routes. It believes it can drive a similar reduction for premium travel between the United States and Europe.

Separately on Thursday, JetBlue announced a biometric self-boarding gate for international flights at New York’s John F. Kennedy International Airport (JFK), becoming the first domestic airline to launch the use of facial recognition technology to verify passengers with a quick photo capture for international travel.

JetBlue has 14 million annual JFK customers.

(Reporting by Tracy Rucinski; Editing by Leslie Adler)

Image from www.jetblue.com