PARIS, Oct 7 (Reuters) – France’s Dassault Aviation and Europe’s Airbus have stepped up pressure on France and Germany to agree on the next stage of a planned fighter project, warning Europe’s arms industry and long-term security could suffer from delays.

The two companies are the leading industrial partners in a project to build a futuristic swarm of manned and unmanned warplanes, announced by the leaders of France and Germany two years ago and expanded earlier this year to include Spain.

Dassault and Airbus won a 65-million-euro contract in January to develop the concept for the Future Combat Air System (FCAS) but await a new contract to build demonstrators for interlinked fighters, drones and an “air combat cloud” by 2026.

Dassault Aviation Chief Executive Eric Trappier told a conference of policymakers last month that the demonstrator contract should have been launched in September but this was now slipping towards end-year. He called it “indispensable” to avoid any further delays in order to maintain the 2026 deadline.

No reason has been given for the delays.

On Monday evening, Dassault and Airbus amplified those warnings with a joint statement.

“If Europe does not move forward — and move forward quickly — on this programme, it will be impossible to maintain the development and production capabilities needed for a sovereign defence industry,” the companies said.

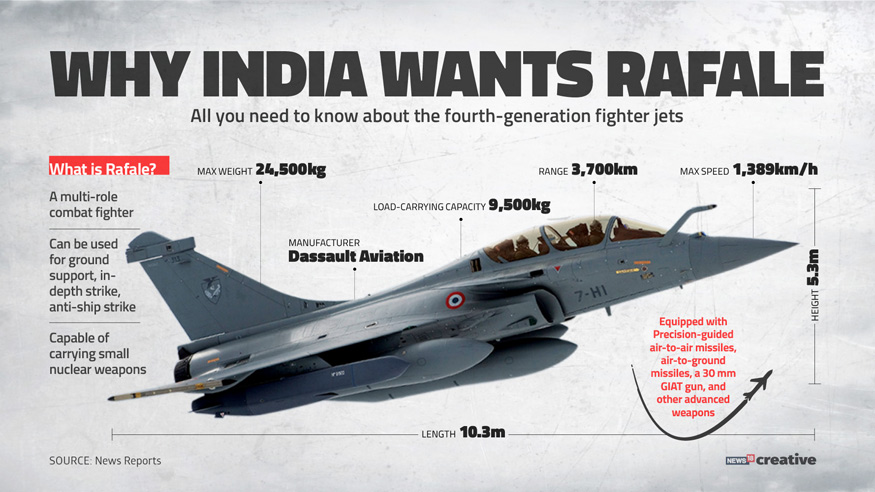

The warplane system is expected to be operational from 2040, with a view to replacing Dassault’s Rafale and the four-nation Eurofighter, in which Airbus represents both Germany and Spain.

The new project faces competition from Britain and its plans for a new combat jet dubbed “Tempest”.

The fighter developments have split the current Eurofighter consortium and led to a shake-up of industrial alliances as Italy joins Eurofighter partner Britain on Tempest, turning its back on Germany and Spain, while Sweden has opened the door to abandoning its independent stance by co-operating on Tempest.

The FCAS is also overshadowed by differences between France and Germany over export policy after Germany imposed a ban on arms exports to Saudi Arabia over the death of killing of journalist Jamal Khashoggi a year ago by Saudi operatives.

The ban, recently extended to March, has raised questions over a long-delayed Saudi border systems contract run by Airbus.

Airbus Defence and Space Chief Executive Dirk Hoke called in a magazine interview last week for the export ban to be relaxed. German Chancellor Angela Merkel’s government has said there is no reason for the moratorium to be lifted.

France and Germany are expected to discuss the issue at ministerial meetings this week.

AIRBUS SETBACK IN SPAIN

Airbus meanwhile faces a battle to shore up its position as a top defence contractor in Spain after losing its place as the representative of Spain’s interests on the upcoming fighter project to local defence electronics firm Indra Sistemas.

Spain last month named Indra as contractor for the Spanish share of the Franco-German-led FCAS project, displacing Airbus from the Spanish coordinator role it had held on Eurofighter.

Airbus officials have pledged to try to overturn the move but a Spanish defence source told Reuters there was no change in the decision.

Indra declined to comment.

Publicly, Airbus has said it was surprised by the decision but has pledged to continue to defend Spain’s best interests.

Dassault will meanwhile mark a long-awaited milestone on Tuesday when it delivers the first of 36 Rafales to India, the culmination of a fighter procurement process that lasted almost 20 years and involved the cancellation of a much larger deal.

La Tribune reported on Monday that France and India were discussing a possible repeat order for 36 more Rafales.

(Additional reporting by Emma Pinedo Gonzalez in Madrid, Tassilo Hummel in Berlin, Editing by Deepa Babington)