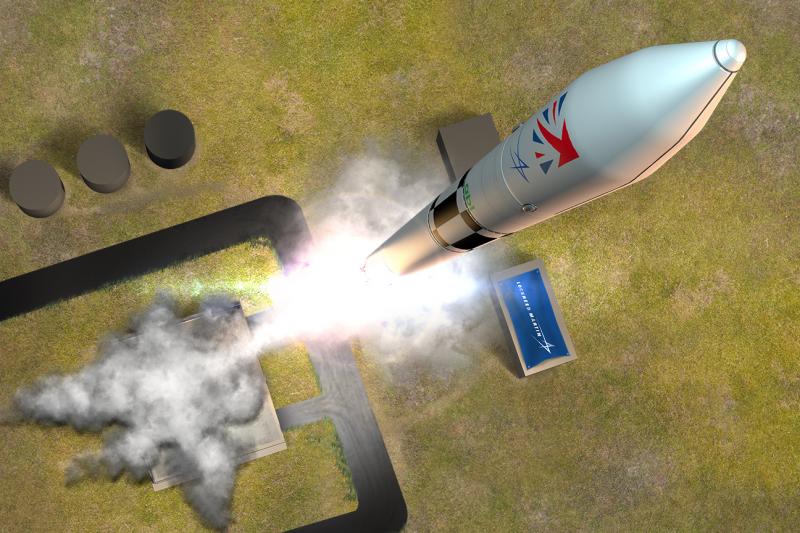

HARWELL, Oxford, Feb. 8, 2021 – Lockheed Martin [NYSE: LMT] has contracted ABL Space Systems, of El Segundo, California, a developer of low-cost launch vehicles and launch systems for the small satellite industry, to supply a rocket and associated launch services for the company’s first UK vertical satellite launch.

The project known as UK Pathfinder Launch is planned to be the first ever vertical small satellite launch from UK soil, from Scotland in 2022. It will also be the first UK commercial launch for U.S.-based ABL Space Systems’ new RS1 rocket.

Nik Smith, Regional Director, Lockheed Martin Space, said: “We are absolutely committed to the success of this programme and the world class capability that ABL Space Systems brings will allow us to build on our long-standing partnership with the UK and strengthen the growth of the UK space sector, aligned to the UK Government’s prosperity and industrial strategy.”

ABL Space Systems’ flexible, integrated GSO launch system, and RS1 rocket, allows for a rapid and cost-effective deployment with outstanding launch performance.

Lockheed Martin’s UK Pathfinder Launch supports the UK Space Agency’s commercial spaceflight programme – Launch UK. In October, the UK Space Agency confirmed Lockheed Martin’s plans to move its programme to the Shetland Space Centre and in January, planning proposals were submitted for the space launch facility in Unst.

Ian Annett, Deputy CEO, UK Space Agency said: “We want the UK to be the first in Europe to launch small satellites into orbit, attracting innovative businesses from all over the world, accelerating the development of new technologies and creating hundreds of high-skilled jobs across the whole of the UK. Lockheed Martin’s selection of ABL Space Systems for their UK Pathfinder launch brings us one step closer to realising this ambition – putting the UK firmly on the map as Europe’s leading small satellite launch destination.

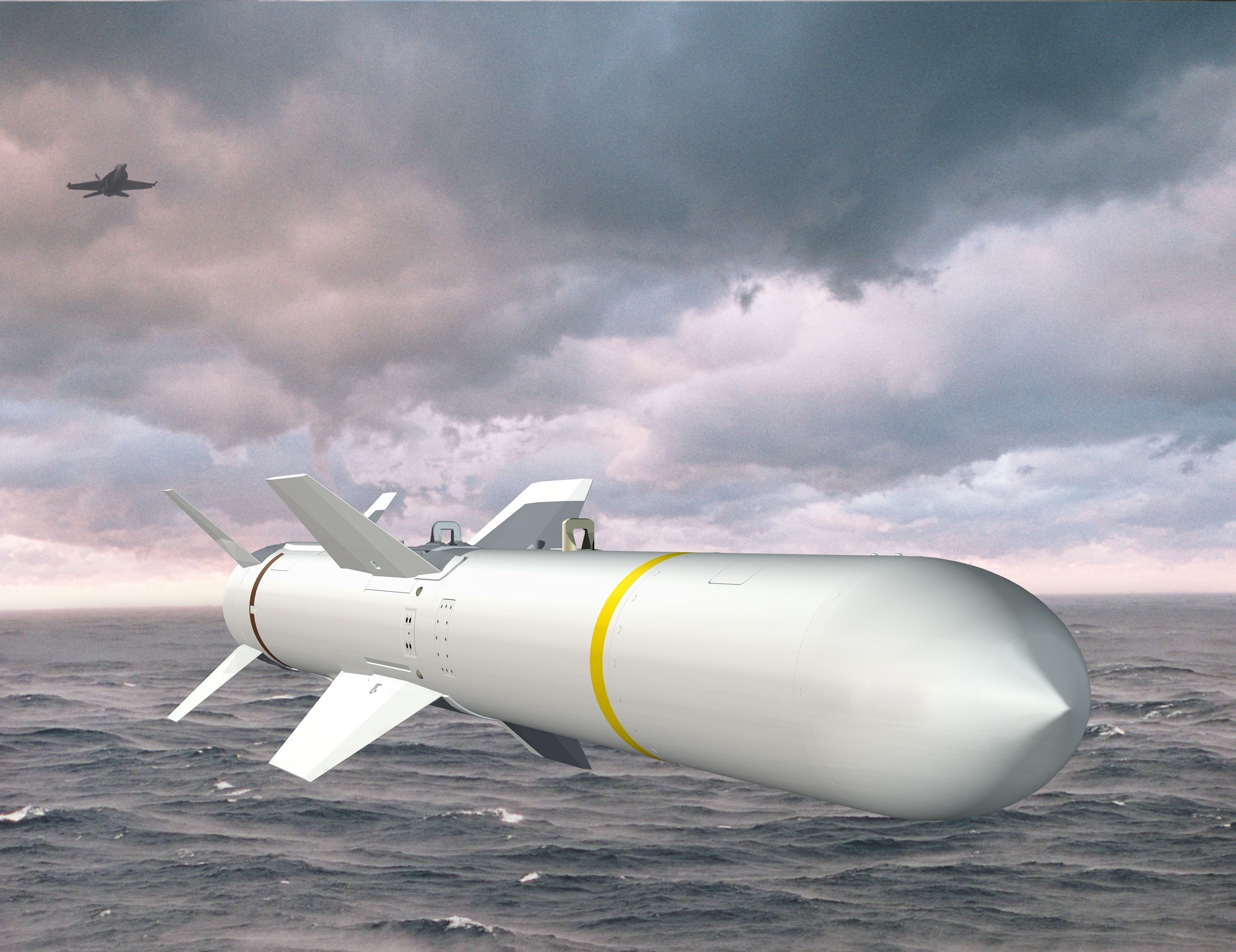

The addition of ABL Space Systems as a partner completes Lockheed Martin’s UK Pathfinder Launch programme team. On launch day, ABL Space Systems’ RS1 rocket will lift off from Shetland Space Centre, in Unst, Shetland, the UK’s most northerly island. Once in orbit, the rocket will release a small launch orbital manoeuvring vehicle, an agile platform built by MOOG, in Reading, UK, which can carry and deploy up to six 6U CubeSats, optimising orbital placement and timing for each small satellite’s respective missions.

To demonstrate the full value of this new UK space transportation capability, two of the CubeSats deployed will be Lockheed Martin’s own technology demonstration spacecraft.

In 2019, ABL Space Systems announced that it had received a strategic investment from Lockheed Martin Ventures to advance the launch provider’s development and test programme.