DEARBORN, Mich. (Reuters) – Investors sent Ford Motor Co shares skidding on Tuesday after the company delivered a weaker-than-expected 2020 forecast, warning of higher warranty costs, lower profits at its credit arm and continued investments in future technology such as self-driving cars.

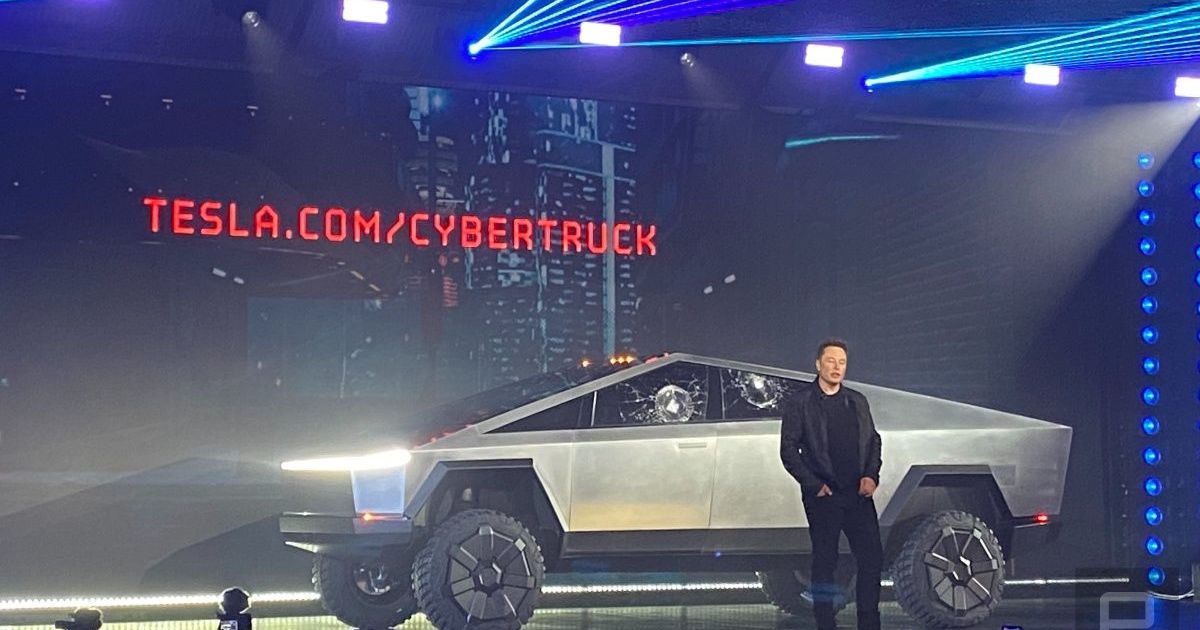

Shares in the No. 2 U.S. automaker plunged 9.4% in after-hours trading, shaving more than $3 billion off the company’s value. In comparison, electric carmaker Tesla closed up nearly 14%, pushing its market cap to $160 billion, more than four times the size of Ford’s $36.4 billion.

“The results were not OK in 2019,” Ford Chief Financial Officer Tim Stone told reporters at the company’s headquarters outside Detroit.

“As I look to 2020 and beyond, I’m very optimistic,” he said, while cautioning that Ford’s lower guidance does not yet account for the potential impact of the coronavirus outbreak in China.

In an after-hours call with financial analysts, Chief Executive Jim Hackett was more blunt about the challenge of balancing Ford’s protracted turnaround efforts with its continuing work on future technology, including electric and self-driving cars.

“I don’t think this company can keep straddling the old and new worlds forever … This company has to change,” Hackett said.

Ford said it expects 2020 operating earnings to be in the range of 94 cents to $1.20 a share. Analysts were expecting $1.26 a share.

Stone said Ford expects to continue its quarterly dividend of 15 cents, which could cost the company $2.4 billion in 2020. Asked about continuing the dividend after lowering its 2020 guidance, Hackett said, “We like to return value to shareholders.”

The disappointing 2020 forecast, coming after Ford previously trimmed its 2019 outlook, is a blow for Hackett, who took the helm in May 2017.

He has been asking investors to be patient with a restructuring that has seen the formation of a wide-ranging alliance on commercial, electric and autonomous vehicles with Volkswagen AG <VOWG_p.DE> and the sale of its money-losing operations in India to a venture controlled by India’s Mahindra & Mahindra.

But by Ford’s own accounting, the restructuring is far from complete. It has booked $3.7 billion of the projected $11 billion in charges it previously said it would take, and expects to book another $900 million to $1.4 billion this year.

For the fourth quarter of 2019, Ford reported a net loss of $1.7 billion, or 42 cents a share, compared with a loss of $100 million, or 3 cents a share, a year earlier.

The quarter included a loss of $2.2 billion due to higher contributions to its employee pension plans, something it disclosed last month.

Revenue in the quarter fell 5% to $39.7 billion, above the $36.5 billion Wall Street had expected.

Ford’s adjusted free cash flow fell 67% in the fourth quarter to $500 million, including the $600 million cost of bonuses related to a new labor deal with the United Auto Workers union. The UAW deal also played a role in driving North American automotive profit margins down to 2.8% in the fourth quarter.

Ford said its operating losses in China last year totaled $771 million, including a loss of $207 million in the fourth quarter. It lost $1.5 billion in 2018. Ford’s market share in China in the fourth quarter fell to 2% from 2.3% last year.

In December, Ford said it would halve its operating loss in 2019 and nearly halve it again in 2020, followed by further improvement in 2021.

However, that forecast was before the appearance of the fast-spreading coronavirus and its crippling effects on China’s economy.

Ford’s China sales fell about 15% in the fourth quarter and 26% for the year as it continued to lose ground in its second-biggest market. Ford has been struggling to revive sales in China since its business began slumping in late 2017.

Detroit rivals General Motors Co and Fiat Chrysler Automobiles are scheduled to report their results on Wednesday and Thursday, respectively.

(Reporting by Ben Klayman and Paul Lienert; Editing by Tom Brown)