American Airlines is recognizing the loyalty of AAdvantage® members by extending their elite status amid reduced travel related to the coronavirus (COVID-19). Changes include:

- Extending elite status for AAdvantage members until Jan. 31, 2022.

- Reducing elite status qualifications for 2020.

- Extending Admirals Club® memberships purchased from American for 6 months.*

- Introducing up to $400 special credits for future travel on American Airlines Vacations packages for elite members.**

- Every dollar spent on an eligible AAdvantage co-branded credit card through the end of 2020 will count for one mile toward Million Miler℠ status.

- Award reinstatement fees waived for travel through September 2020.

“We are grateful to our AAdvantage members and want to show them that loyalty is a two-way street,” said Bridget Blaise-Shamai, Vice President of Customer Loyalty & Insights and President of the AAdvantage program. “When people are ready to fly again, we will be there to help them reconnect with loved ones, friends and colleagues.”

Extended AAdvantage elite status

AAdvantage members will automatically receive an extension of their current elite status through Jan. 31, 2022. These updates will be reflected in member accounts in a few weeks.

Admirals Club membership extension

Admirals Club memberships and One-Day Passes purchased from the airline will be automatically extended for 6 months beyond their expiration date as part of American’s effort to care for customers.*

American Airlines Vacations credit

Elite members will also receive a special credit up to $400 to use toward an American Airlines Vacations package, giving customers something to look forward to when travel resumes. Customers can receive the credit when they call American Airlines Vacations to book a trip. Members can learn more by visiting aa.com.**

Making it easier to earn elite status

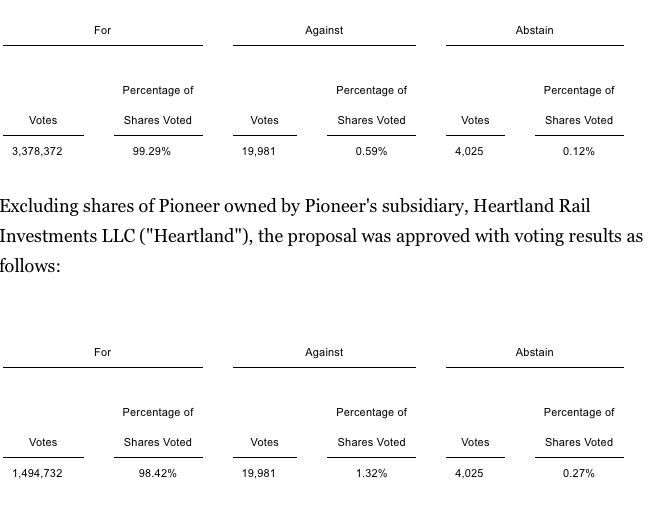

Lowered elite qualification requirements

The airline has lowered AAdvantage elite qualification requirements for all of 2020. AAdvantage members will achieve status more easily during the current elite qualifying year through lower Elite Qualifying Dollar (EQD), Elite Qualifying Mile (EQM) and Elite Qualifying Segment (EQS) requirements.

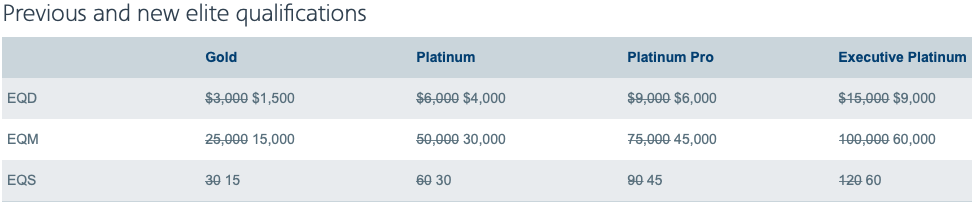

Reduced qualifications for Executive Platinum rewards

Members who qualify for Executive Platinum status previously received a choice of one reward upon reaching 150,000, 200,000 and 250,000 EQMs. Lowered EQM requirements in 2020 will now make these rewards more attainable.

The above changes will take effect by May 15, 2020.

$1 spent on eligible AAdvantage credit cards equals 1 mile toward Million Miler status

For all Citi®/AAdvantage and AAdvantage Aviator® products, as well as select AAdvantage credit cards outside of the United States, every dollar spent on net purchases that post to your AAdvantage account between May and December 2020 will count as one mile toward Million Miler status.

Making travel more flexible

Waived award reinstatement fees for travel

The airline is also giving members more flexibility with waived reinstatement and change charges for awards booked by May 31, 2020 for travel through September 30, 2020.

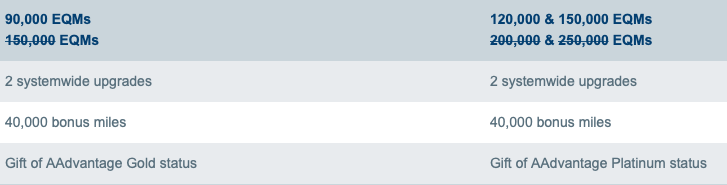

Award travel ticketed on or after June 1, 2020 will include free changes if made at least 60 days in advance. A new variable fee structure based on elite status and days before departure will apply to any changes made fewer than 60 days in advance:

More information about these updates is available on aa.com. Customers and AAdvantage members with questions about other actions regarding COVID-19 should visit www.aa.com/coronavirus.

*The membership extension applies to all active members as of March 1, 2020. New annual Admirals Club memberships purchased between March 1 and May 31, 2020 will also be extended for 6 months beyond the normal 12 months. For Admirals Club One-Day Passes, the extension applies to any unused passes with an expiration date between March 1, 2020 and May 31, 2021.

**Terms and conditions apply. Note only U.S. point of origin bookings.