BEIJING/FRANKFURT (Reuters) – Daimler’s <DDAIF> main Chinese joint venture partner BAIC Group has signalled its intention to increase its stake in the German luxury car manufacturer, sources briefed on the matter said, after it built up a 5% Daimler holding in July.

Officials at BAIC’s listed company, BAIC Motor Corp Ltd, said at investor conferences in mid-October that “both sides are willing to increase stakes in the other”, responding to questions about future relationship between BAIC Group and Daimler, the sources said.

Daimler said in a regulatory filing on Friday that HSBC held 5.23% in Daimler’s voting rights directly as well as through instruments such as equity swaps as of Nov 15. BAIC has used HSBC to help it build its initial 5% stake.

Sources declined to be named as they are not allowed to speak to media.

A Daimler spokesman on Monday said, that the company had received notification from HSBC that the voting stake of 5% has been exceeded.

While the spokesman would not say whether BAIC played a role in the transaction, he added that Daimler welcomed long-term shareholders such as BAIC, who support the carmaker’s strategies.

“Daimler AG appreciates BAIC as long-standing partner and long-term investor,” the spokesman said in a written statement.

“Such shareholders help us to further safeguard and strengthen the capitalization of our company,” the statement continued.

BAIC was not immediately available for comment.

Geely, Daimler’s biggest shareholder with a 9.7% stake, said: “We are a long-term investor in Daimler. We do not react spontaneously to any volatility and we support Daimler’s management and their strategy.”

BAIC (Beijing Automobile Group Co Ltd) has been Daimler’s main partner in China for years and operates Mercedes-Benz factories in Beijing through Beijing Benz Automotive.

Two months before its July stake deal was announced, sources told Reuters that BAIC wanted to invest in Daimler to secure its investment in Beijing Benz Automotive.

In March, sources told Reuters Daimler had asked Goldman Sachs <GS> to help it explore increasing its stake in BAIC’s Hong Kong-listed company.

The partners also planned to revamp manufacturing facilities to make Mercedes Benz-branded trucks via their commercial vehicle joint venture Foton Daimler Automotive (BFDA), Reuters reported in August citing a document and sources familiar with matter.

The companies also said Daimler and BAIC’s new energy vehicle unit BluePark have jointly developed a battery research lab in Beijing.

State-owned BAIC built its stake after Li Shufu, chairman of rival private automaker Zhejiang Geely Holding Group, built a 9.69% stake in Stuttgart-based Daimler in early 2018.

By using Hong Kong shell companies, derivatives, bank financing and structured share options, Li kept the plan under wraps until he was able, at a stroke, to become Daimler’s single largest shareholder.

Since the investment, Geely and Daimler have said they plan to build the next generation of Smart electric cars in China through a joint venture.

Zhejiang-based Geely owns Volvo while BAIC in addition to Daimler has a partnership with South Korea’s Hyundai Motor <HYMTF>.

Daimler said it had collaborated with BAIC in areas such as production, research and development and sales since 2003.

(Reporting by Yilei Sun and Edward Taylor; additional reporting by Arno Schuetze and Ludwig Burger; editing by Brenda Goh, Jason Neely and Louise Heavens)

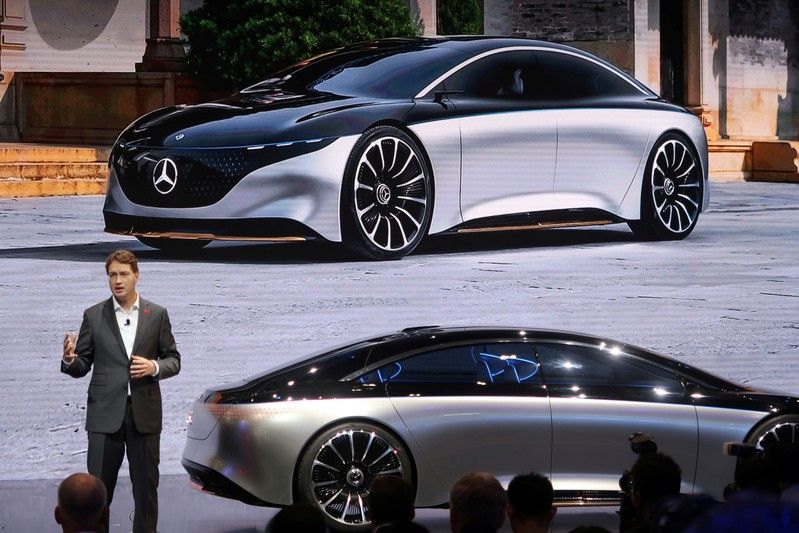

FILE PHOTO: Ola Kaellenius, Chairman of the Board of Management of Daimler AG, speaks at a media event during the Guangzhou auto show in Guangzhou