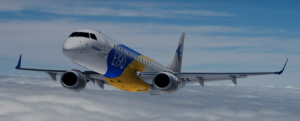

SAO PAULO, Jan 22 (Reuters) – Avianca Brasil, which filed for bankruptcy protection in December, is looking for a cash injection and has hired Brazilian consulting firm Galeazzi & Associados to help in talks with investors and creditors, the airline said.

Galeazzi’s executives are already visiting the carrier’s creditors to discuss options, a source said, asking for anonymity to disclose private talks. Reuters first reported the news of the Galeazzi hire, citing sources.

Avianca shareholders are discussing a potential cash injection with different investors, including hedge fund Elliott Management Corp, two sources said. Any investment now would need to happen within the bankruptcy protection process, likely in the form of debtor-in-possession financing.

Elliott and Galeazzi did not immediately reply to requests for comment.

Any capital injection or loan would need authorization from the bankruptcy judge.

Avianca is battling two of its main aircraft lessors, Aircastle Ltd and General Electric Co’s unit GE Capital Aviation Services, who have tried so far unsuccessfully to ground or repossess 40 percent of its fleet.

Avianca also said in the statement it continues to operate normally.

The escalating legal battle has added to the uncertainty surrounding Avianca Brasil’s ability to maintain its current flight schedule.

(Reporting by Tatiana Bautzer Editing by Susan Thomas and Alistair Bell)