LONDON (Reuters) – Rolls-Royce dropped out of the race to power Boeing’s planned mid-market aircraft on Thursday, saying it did not want to risk more disruption for its airline customers by rushing out a product without extensive testing.

The move strengthens a leading position in the high-profile contest already held by a transatlantic venture involving Rolls’ arch-rival General Electric, industry sources said,

Britain’s Rolls-Royce, which makes engines for large civil aircraft and military planes, wants to avoid a repeat of the problems with its Trent 1000 engine that powers Boeing’s Dreamliner 787.

Chief Executive Warren East said he had taken the “very difficult decision” to withdraw from the Boeing competition because it couldn’t make the development of its new UltraFan architecture fit the timetable for the aircraft.

Boeing has proposed launching a new mid-sized jetliner to fill a gap between the narrow and wide-body aircraft, with airline operations beginning in 2025.

“If you enter into service with an engine that is not sufficiently mature, then you are almost inevitably going to run into lots of in-service issues, lots of customer disruption and lots of incremental costs,” East told reporters.

He said, however, that Rolls was still committed to UltraFan, a major new fuel-efficient architecture that will power wide-body jets towards the back end of the next decade.

CFM International — a joint venture between GE and France’s Safran — as well as Pratt & Whitney are also potential suppliers for the new Boeing jet.

Pratt & Whitney recently re-entered the civil market for narrow-body jets and wants to expand to larger ones, but has been hit by industrial problems.

UNHAPPY CUSTOMERS

In the nearer term, Rolls is still dealing with the costs and disruption of fixing Trent 1000 engines caused by the poor durability of components.

“On this issue we have indeed turned the corner,” East said, although he added that the level of customer disruption was still unacceptable.

It raised the Trent 1000 charge to 790 million pounds from 554 million pounds at the half year, contributing to a full-year operating loss of 1.16 billion pounds ($1.54 billion), and allocated another 100 million pounds in cash to the problem.

The issue has damaged Rolls’ standing with its big customers.

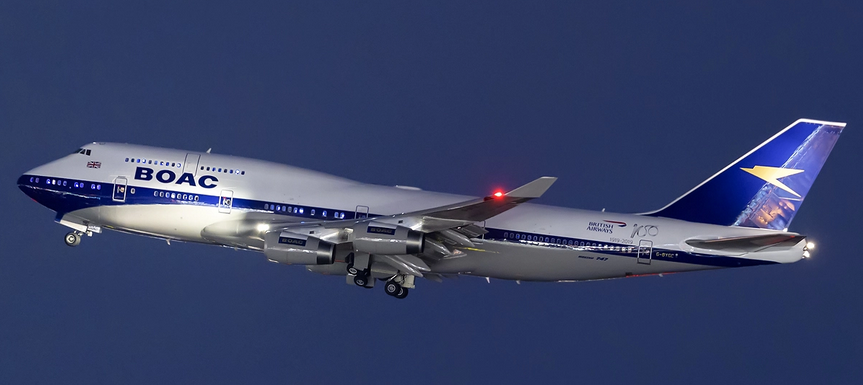

British Airways owner IAG said on Thursday it would order 18 Boeing 777-9s, rather than a competing package from Airbus that industry sources said included the A350, which is powered by Rolls.

“I have been frustrated, largely with the performance of Rolls-Royce, not so much with Airbus,” IAG Chief Executive Willie Walsh said.

East, however, said Rolls had an excellent relationship with BA and put the choice down to IAG’s fleet requirements.

“I am totally confident we will be continuing to be a major partner with BA for many, many years into the future,” he said.

East said that aside from Trent 1000, the rest of the business was performing well, although the large engine deliveries of 480 fell short of its 500 target, in part due to the challenge of stepping up Trent 7000 production.

Shares in Rolls were trading down 3.4 percent at 950 pence, underperforming a 1 percent drop in the FTSE 100.

The company reported a 8 percent rise in underlying revenue to 15.1 billion pounds and a doubling of operating profit to 616 million pounds.

However, changes in Rolls-Royce’s dollar-pound hedge book had a significant impact on its results, and were in part responsible for a reported full-year loss of 2.9 billion pounds.

(Reporting by Paul Sandle, Additional reporting by Tim Hepher; Editing by Edmund Blair and Keith Weir)