Dubai, UAE, January 15, 2024 – Emirates and Azul Linhas Aereas Brasileiras S.A. (Azul) have taken their partnership to new heights with the launch of a reciprocal loyalty program offering. Emirates Skywards and TudoAzul frequent flyer members can now earn and redeem Miles across a joint network of more than 290 destinations worldwide. The two carriers launched a codeshare partnership in 2021 to provide customers enhanced connectivity to/from eight cities in Brazil to Emirates’ global network via Sao Paulo.

More opportunities to earn Miles

Under the agreement, Emirates Skywards members can earn Miles while traveling across Azul’s network of more than 150 destinations. Skywards members earn up to 1 Skywards Mile per mile flown in Economy class, and up to 1.5 Skywards Miles per mile flown in Business Class. Members can also redeem flight rewards on Azul Economy Class on emirates.com (starting from 8,000 Miles for a one-way reward ticket) and Azul Business Class (starting from 17,500 Miles for a one-way reward ticket). The partnership will also enable TudoAzul members to earn Miles across Emirates’ global network of more than 130 destinations, across six continents. Azul members can also enjoy flight rewards on Emirates Economy and Business Class cabins.*

Connecting Brazil to the world

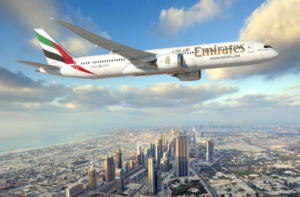

Emirates currently operates a daily A380 service to Sao Paulo, featuring its highly lauded Premium Economy cabin. The airline also operates a Boeing 777-300ER service between Dubai and Rio de Janeiro, which also connects travellers onwards to Buenos Aires. The codeshare agreement with Emirates and Azul allows customers to connect to/from Rio de Janeiro, Santos Dumont (SDU), Belem (BEL) Belo Horizonte (CNF), Cuiaba (CGB), Curitiba (CWB), Juazeiro Do Norte (JDO), Porto Alegre (POA) and Recife (REC) airports on flights operated by Azul to Emirates flights from Sao Paulo (GRU) to Dubai and beyond with a single ticket.