(Reuters) – Icelandair (ICEAIR.IC) has agreed to buy rival Icelandic airline WOW air from its founder for about $18 million in an all-share deal aimed at creating a stronger international competitor.

Airlines are looking to consolidate in many markets as a result of rising running costs, largely to higher oil prices, and increased competition from low-cost, budget carriers.

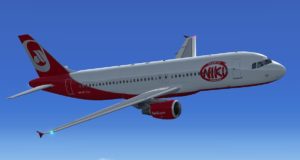

WOW has focussed on low-cost travel across the Atlantic, using smaller single-aisle planes to fly between Iceland and destinations in the United States and Europe.

While there has been some consolidation in Europe over the last year, with Lufthansa and easyJet acquiring parts of failed airline Air Berlin in 2017, the chief executives of the continent’s biggest airline groups say more is to come.

Struggling Italian carrier Alitalia is seeking new investors and British Airways-owner IAG (ICAG.L) bought a stake in Norwegian Air (NWC.OL) with a view to a takeover.

A jump in the oil price could spur more consolidation, as weaker players are likely to suffer over the winter period as costs rise during a period when fewer people tend to fly.

Both Icelandic airlines, which Icelandair said would continue to operate under separate brands, use Keflavik Airport as their main hub between Europe and North America.

Together they have a combined 3.8 percent share of the transatlantic market, Icelandair, which warned on profit in July due to an increase in capacity on some routes across the Atlantic, added in a statement.

Icelandair shares jumped by nearly 50 percent after it announced the WOW takeover, the biggest one day percentage gain in its stock price since September 2009. The headline value of its offer for WOW was based on Friday’s closing share price.

“WOW air has been Icelandair’s main competitor and the acquisition is likely to lead to increase in average fares and better capacity control on the market to and from Iceland.” Arion Banki analyst Elvar Ingi Moller said.

WOW’s founder and sole owner Skuli Mogensen, who will receive 272 million shares in Icelandair, said that the deal will strengthen its international competitiveness.

Moller said WOW, which has 14 Airbus A320 family aircraft and three widebody A330 planes, has come under pressure due to higher oil prices and lower air fares in recent months.

Icelandair said its shareholders are due to meet to vote on the deal in the near future.

(Reporting by Tommy Lund; Additional reporting by Saray Young; Editing by Jon Boyle/Louise Heavens/Alexander Smith)

Image from www.boeing.com