Boeing [NYSE: BA] today released its biennial World Air Cargo Forecast (WACF), reflecting COVID-19 impacts and opportunities as well as substantial long-term demand for freighters over the next two decades.

Enabled by a rebound in global trade and long-term growth, the WACF forecasts demand for 2,430 freighters over the next 20 years, including 930 new production freighters and 1,500 freighters converted from passenger airplanes.

According to the new forecast, world air cargo traffic will grow at 4% per year over the next 20 years. This growth is influenced by trade and growing express shipments to support expanding e-commerce operations. With these developments and the proven need for dedicated freighter capacity to support the world’s transportation system, the global air cargo fleet is expected to grow by more than 60% through 2039.

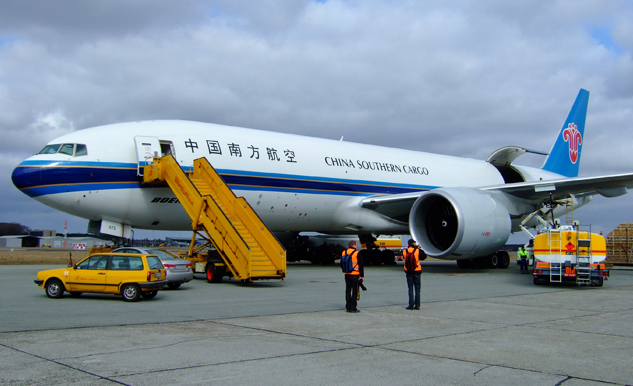

“Freighter operators have been in a unique position in 2020 to meet market requirements for speed, reliability and security, transporting medical supplies and other goods for people and communities around the world,” said Darren Hulst, vice president of Commercial Marketing. “Looking ahead, dedicated freighters will be even more critical to compete in air cargo markets; they carry more than half of air cargo traffic, and airlines operating them earn nearly 90% of air cargo industry revenue.”

In addition to projecting long-term demand for freighters, the WACF provides insights into air cargo performance during the pandemic, including the following:

– E-commerce, which was growing at double-digit rates prior to the pandemic, has accelerated its impact on the air cargo market as more businesses shifted to online selling platforms. Year to date through September, express carriers increased traffic by 14%

– Passenger belly cargo, which in 2019 accounted for about half of the world air cargo capacity, was significantly reduced when airlines parked thousands of planes. Freighter operators responded by operating above normal utilization levels, and traffic for all-cargo carriers grew 6%

– So far in 2020, approximately 200 airlines used more than 2,000 passenger widebody aircraft for cargo-only operations to generate cash flow and support global supply chains. These passenger freighters have taken up some of the capacity shortfall and, in some cases, generated quarterly profits for carriers despite minimal passenger operations