Honeywell (NASDAQ: HON) has been selected by Copa Airlines to provide its Air Separation Module (ASM) kit for Copa’s fleet of Boeing 737 aircraft. This new technology offering is a drop-in replacement for Copa’s existing ASMs, which are installed on larger aircraft to help reduce the risk of fuel tank fires. Copa is the first airline to operate Honeywell’s version of the safety system, which has one of the longest lifespans and warranties in the industry.

As an aircraft uses fuel and its fuel tanks empty, it is critical to decrease the risk of fire by reducing the amount of oxygen that fills that open space. The ASM separates oxygen from nitrogen in the surrounding air, which allows the Nitrogen Generation System to pump nitrogen into the emptying fuel tanks. Honeywell’s ASM can be installed roughly six to eight hours faster than the current product from the original equipment manufacturer. This shortened installation time contributes to lower maintenance costs. Additionally, Honeywell’s ASM has increased durability over other options currently installed in 737 aircraft and is designed to integrate with Honeywell’s Nitrogen Generation System, which has been line-fit on every 737 built after 2008.

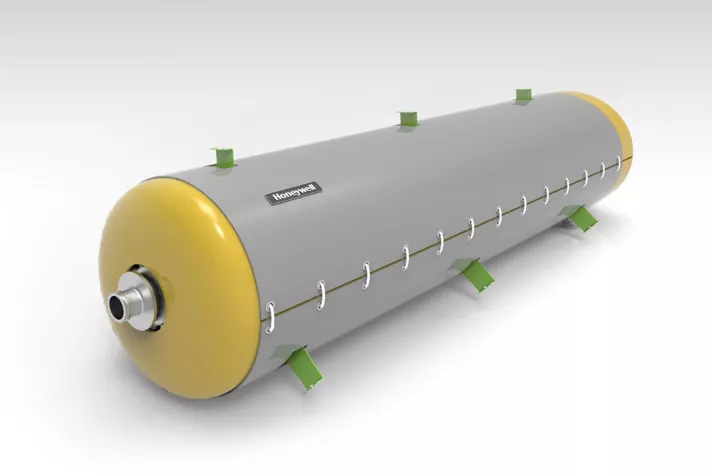

The Honeywell ASM was designed with a high-durability membrane construction to meet the needs of the demanding 737 operating environment. It is supplied as a kit and contains a new Honeywell ASM, complete with all needed blankets and brackets, and ozone destruct filter and instructions for installation.

The ASM will provide lower installation costs for carriers, and with its increased durability, Honeywell is able to guarantee ASM life of seven years without replacement. Because Honeywell is the Nitrogen Generation System integrator, these kits can be combined into existing maintenance plans to further reduce overall customer operating costs.

For more information on Honeywell’s Air Separation Module Kit, visit aerospace.honeywell.com.