FORT WORTH, Texas – American Airlines (NASDAQ: AAL), in partnership with the Port Authority of New York and New Jersey and Unibail-Rodamco-Westfield (URW) Airports, today announced a $125 million commercial redevelopment program for Terminal 8 at John F. Kennedy International Airport (JFK). The project will feature a new Great Hall and is expected to bring more than 60 new shopping and restaurant offerings to the terminal. With an emphasis on locally owned and diverse businesses that will create economic opportunities for the community, the new program will showcase New York’s world-renowned culinary scene and establish a unique sense of place for travelers.

Following the recent completion of a $400 million expansion of Terminal 8, the commercial redevelopment will further enhance the customer experience at the terminal with a complete redesign and expansion of the concessions program, including dining, retail, duty-free shopping, performance space and new digitally enabled experiences for American’s customers.

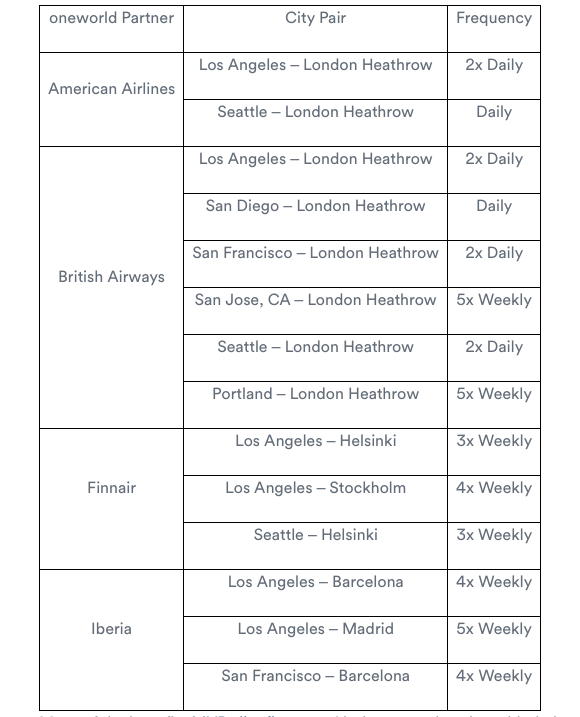

Terminal 8 has also become a world-renowned gateway for American’s oneworld partners. Within the past year, British Airways, Iberia and Japan Airlines relocated operations and Qantas returned service to Terminal 8.

American selected JFK T8 Innovation Partners, a joint venture led by URW, to lead the redevelopment. URW is an owner, developer and operator of sustainable, high-quality real estate assets across Europe and the U.S. Also joining the T8 Partners team, with a 30 percent equity stake, is Phoenix Infrastructure Group, a minority-owned, Minority Business Enterprise (MBE)-certified investment firm focused on critical infrastructure projects; and Holt Construction, one of New York’s premier construction management firms with experience in more than 100 aviation projects at airports across the country, including the expansion of Terminal 8, where Holt exceeded its 30 percent Minority and Women-Owned Business Enterprise (MWBE) participation goal.