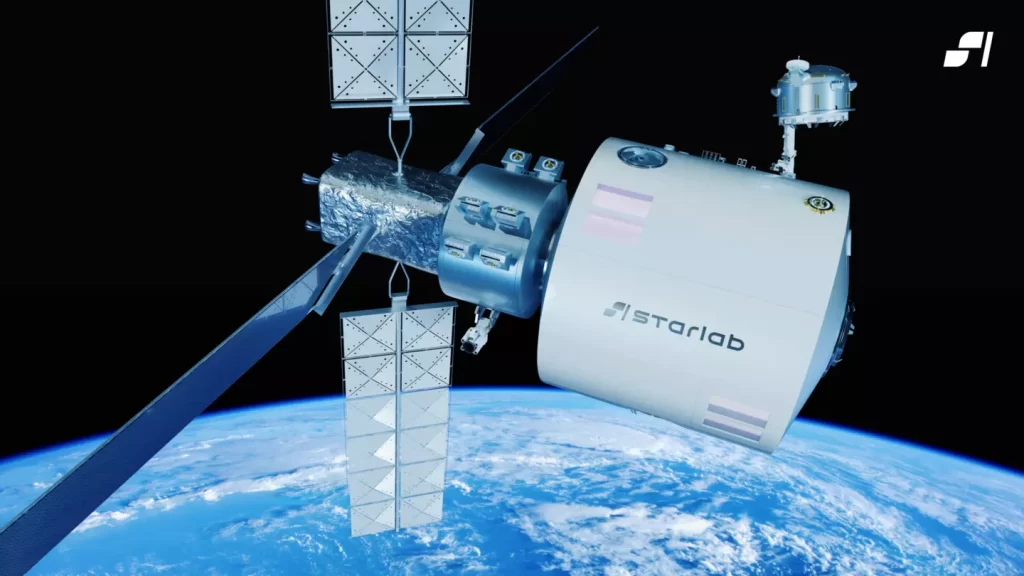

Voyager Space and Airbus Announce Joint Venture to Build and Operate Starlab

DENVER – 02 August, 2023 - Voyager Space, a global leader in space exploration, and Airbus (OTC: EADSY) Defence and Space, the largest aeronautics and space company in Europe, today announced an agreement paving the way for…