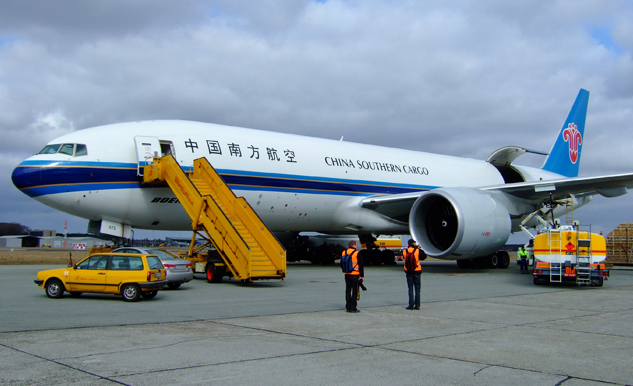

A.P. Moller – Maersk AS (OTC: AMKBY) opens new warehousing & distribution (W&D) facility, spread over 16,000 sq.m. inside the Douala Port zone and powered by a cutting-edge system, will serve mainly the growing demand for FMCG cargo and, potentially, other strategic verticals in Central Africa.

The state-of-the-art facility with modern WMS will provide customers with accurate and real-time visibility of their inventory. Full traceability using lot, batch, and serial numbering will ensure efficient movement of goods. Ultimately, the optimised operations using technology will aid in reducing waste and inventory errors and provide an improved experience to customers.

Maersk has a clear goal of being Net Zero by 2040, and every new investment being made has deep considerations in terms of the decarbonisation of logistics. The new facility by Maersk in Douala is no exception. 100% internal lighting will be done using low-consumption LED lights, and all external lighting will be powered by solar energy. All forklifts required in the W&D operations will be battery-operated and charged using solar energy. At the beginning of operations, 15% of the site’s electricity requirements will be fulfilled by solar panels installed at the site itself, with a plan to scale up in the coming years.

Maersk’s customers will get several benefits by utilising this facility for bonded as well as non-bonded storage and distribution. Bundled with ocean transportation, customs clearances, intermodal transportation and other services, Maersk will provide truly integrated logistics solutions to its customers. Such a solution also adds greater control over supply chains and offers higher resilience. With everything put together, customers will get cost advantages, too, as all their logistics requirements get fulfilled under the same roof.