Dubai, UAE, January 23, 2024 – Emirates has announced a fifth frequency on its Dubai – Rio de Janeiro route, starting on December 7, 2024. The additional weekly flight on Saturdays will provide increased capacity on its service to the Brazilian city and will support the growing demand for travel on the route. Additionally, the linked service allows travellers to conveniently travel onwards to the Argentinian capital city of Buenos Aires.

Emirates’ increase in capacity on its Dubai – Rio de Janeiro – Buenos Aires route will help the airline to meet market demand and offer customers greater flexibility, choice, and connectivity. With the fifth scheduled service, customers will now have more choice when selecting flights to suit their travel plans.

The additional weekly frequency between Dubai, Brazil and Argentina will operate as EK247 and EK248 in a 2-class configuration. Tickets can be booked immediately on emirates.com, the Emirates App, and travel agencies.

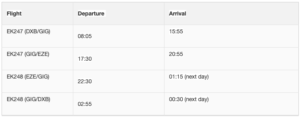

EK247 and EK248 is scheduled to operate with timings as follows (all times are local):

The airline’s boosted services to Brazil and Argentina are expected to facilitate additional connectivity for passengers travelling between these countries and other popular destinations in Emirates’ network including the UAE, Japan, Thailand, Maldives, Egypt, mainland China and Hong Kong, Turkey, South Korea, India, Australia and Indonesia. With Brazil and Argentina being home to the two largest Lebanese communities in Latin America, Emirates regularly serves customers travelling to and from Beirut. Furthermore, nationals of Brazil and Argentina can also enjoy the convenience of visa-free travel to Dubai, making it a popular destination for holidays and short stopovers.