Seattle, Washington, September 13, 2023, PRNewswire – Boeing [NYSE: BA] and SMBC Aviation Capital announced today the airplane lessor is ordering 25 737-8s. The new order increases SMBC’s backlog to 81 737 MAX jets focused on the market-leading 737-8.

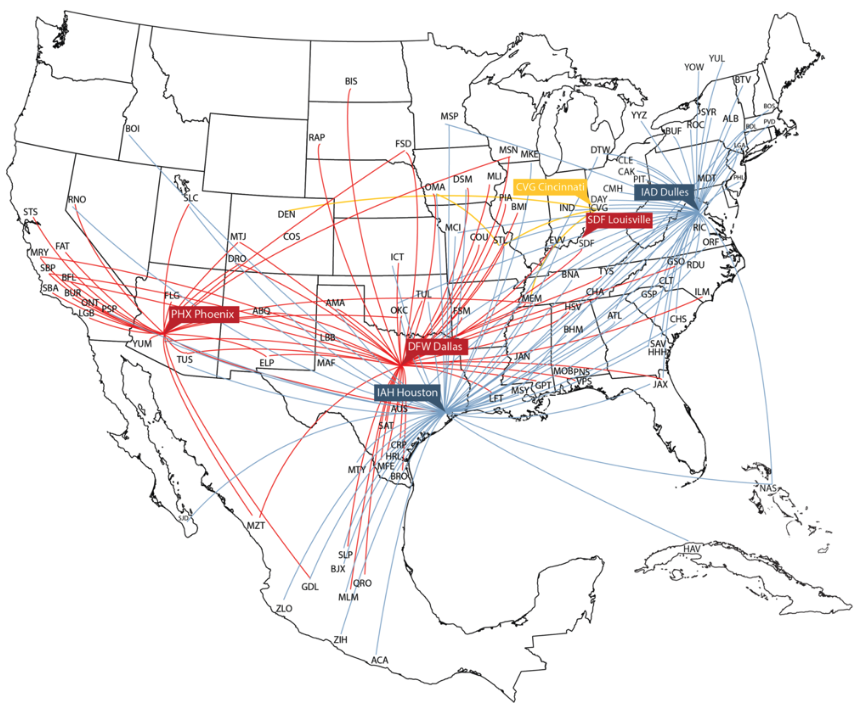

With travel demand surging around the globe, lessors are looking to increase their single-aisle portfolios to provide airlines with more fuel-efficient jets capable of operating across various route networks.

The 737-8 provides flexibility across airline’s networks while reducing fuel use and emissions by up to 20% and on average. Each airplane will save up to 8 million pounds of CO2 emissions annually compared to those airplanes it replaces. Boeing has secured more than 400 737 MAX family orders in 2023.

The 737-8 seats 162 to 210 passengers depending on configuration with a range of 3,500 nautical miles and operates profitably on short- and medium-haul routes.