Singapore – February 20, 2024 – Eve Air Mobility (NYSE: EVEX) and SkyScape, a Japanese vertiport development and management company headquartered in Osaka, Japan, have announced an agreement to use Eve’s Urban ATM (air traffic management) as a part of the Advanced Air Mobility (AAM) concept of operations published by the Japanese government. The announcement makes Skyscape Eve’s 13th Urban ATM customer and it becomes its sixth Urban ATM vertiport customer as the company continues to grow its business globally.

Eve’s Urban ATM software solution is a key enabler to the efficient implementation and scalability of urban air mobility (UAM) by providing services for air navigation service providers, urban authorities, fleet operators, vertiport operators, and other UAM stakeholders. The solution includes UAM flight coordination, vertiport automation airside support, airspace flow management and conformance management.

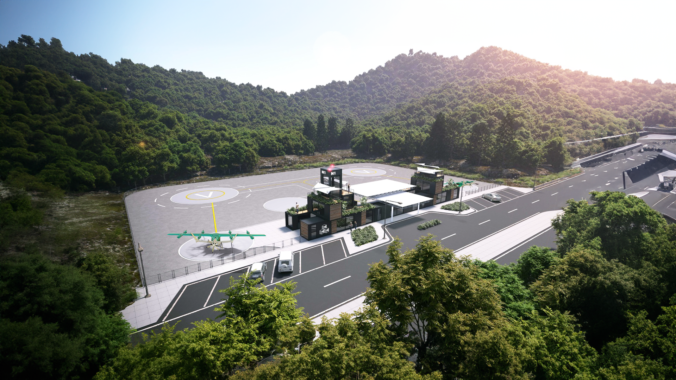

As part of the agreement, the two companies will collaborate in a number of different ways including promoting Urban Air Mobility in Japan and the test and trial of Urban ATM software including data collection and sharing. The companies will also work together on showcasing eVTOL design and testing, vertiport design, operation certification and future autonomous operation development at SkyScape locations including their planned country research site known as the “Integrated Aviation Center” (IAC) when it opens in the future.

Forward-Looking Statements

This press release may contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including expected delivery dates. Such statements are based on current expectations and projections about our future results, prospects and opportunities and are not guarantees of future performance. Such statements will not be updated unless required by law. Actual results and performance may differ materially from those expressed or forecasted in forward-looking statements due to a number of factors, including those discussed in our filings with the Securities and Exchange Commission.