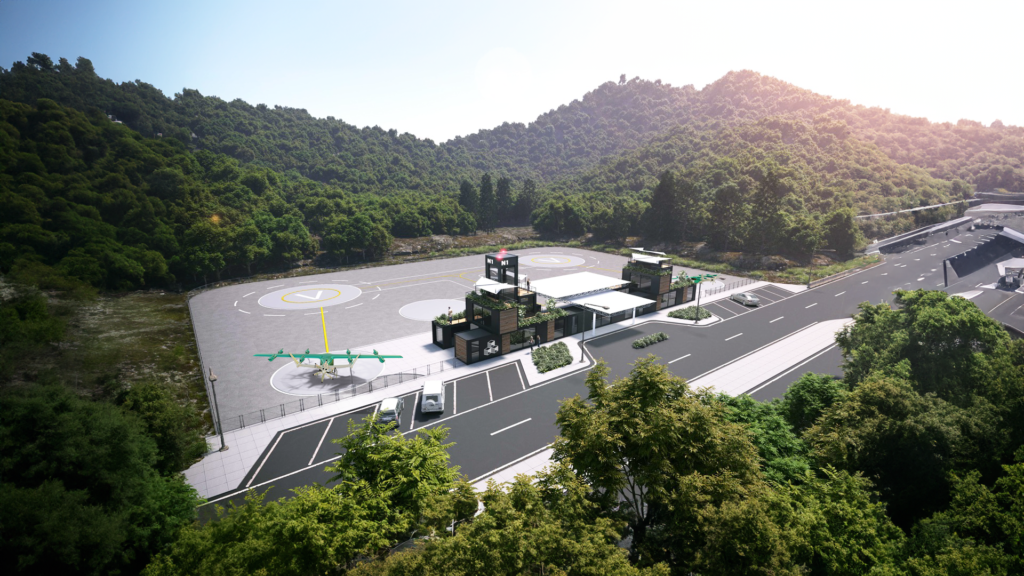

Eve Air Mobility and SkyScape announce first urban ATM agreement in Japan

Singapore – February 20, 2024 – Eve Air Mobility (NYSE: EVEX) and SkyScape, a Japanese vertiport development and management company headquartered in Osaka, Japan, have announced an agreement to use Eve’s Urban ATM (air traffic…