KiwiRail has named world-renowned Hyundai Mipo Dockyard (HMD) based in Ulsan, South Korea as its preferred shipyard to build the two new Interislander ferries.

KiwiRail Chief Executive Greg Miller said the decision to work with HMD was a significant step forward for the new Interislander project and the culmination of a robust, competitive, year-long selection process.

“Our ship procurement team and the evaluation panel, including naval architects, ship brokers and maritime lawyers, have undertaken a rigorous process to select the right shipyard and this announcement, on schedule, is a great end to the year for our team,” Mr Miller said.

“KiwiRail has specified a Makers’ List of components – predominantly American and European, including the engines, propulsion system and navigation system – to ensure the new ships will serve New Zealand well for the next 30 years.

“The two new ferries and the upgraded terminals in Waitohi Picton and Wellington are a major investment in the future of the Cook Strait freight and passenger services, with a significant taxpayer contribution. It’s crucial that we deliver the best outcome for New Zealand and for our passengers and customers and with the selection of HMD shipyard, I am confident we have achieved that.”

Once commissioned and built, the two new ferries will replace KiwiRail’s three ageing Interislander ferries,which are nearing the end of their working lives. KiwiRail operates around 3800 services a year, transporting about 850,000 passengers, 250,000 cars and up to $14 billion worth of freight, but with significant growth predicted.

New terminals and berths in Waitohi Picton and Wellington are planned to accommodate the new ferries and improve the Interislander service for customers and staff.

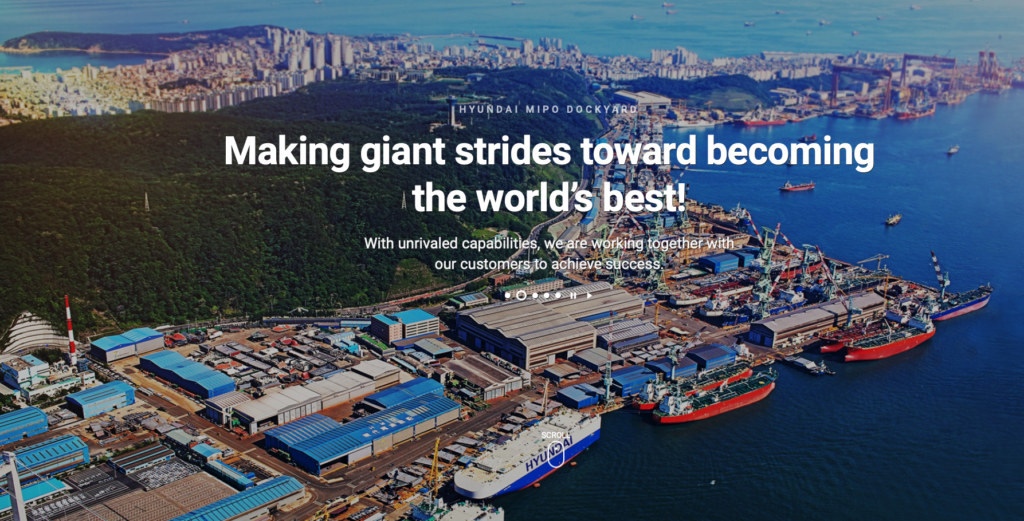

HMD is the world’s sixth-largest shipbuilder globally with decades of experience building complex ships, including HMNZS Aotearoa for NZDF.

It is over 20 years since New Zealand introduced a brand-new purpose-built ferry to its fleet. Once built, the two new ferries will be more efficient and support KiwiRail’s goal to reduce carbon emissions by 30 per cent by 2030 and be carbon neutral by 2050. The new ferries will be designed to use different energy sources through their life if these are available in New Zealand, and at day one will provide for battery operations when docking and plug into local power supply at each port.

The Government committed $400 million in Budget 2020 to the New Interislander project, building on a $35 million-dollar investment in Budget 2019.

Massimo Soprano, Ships Programme Manager at KiwiRail, said the selection process had been highly competitive with some of the best shipyards in the world putting in tenders for the contract.

Mr Miller said that despite the complexity and number of parties involved in the purchase of the two new ferries and the terminal upgrades in both Waitohi Picton and Wellington, things were progressing well with the new Interislander project.

A Letter of Intent (LOI) has now been signed with HMD. A LOI is a non-binding agreement that allows KiwiRail and HMD to progress to more detailed contract negotiations and is a normal step in the procurement process for large-scale ship building.