Tesla (TSLA) posted a surprise second-quarter profit last week on cost cutting and strong deliveries, offsetting the effects of its Covid-19 related factory shutdowns. The report may help the electric vehicle manufacturer gain inclusion into the S&P 500 index (^SPX).

Tesla announced earned net income of $104 million for the quarter, or $0.50 per share. This marks the first time the company has posted four straight quarterly profit, a benchmark for the company to be considered for inclusion in the highly coveted S&P 500.

This marks another major win for Chief Executive Elon Musk, whose quest to lead the global auto industry with Tesla, and the aerospace industry with SpaceX, has increasingly been making major leaps forward.

Musk said last Wednesday that the city of Austin, located in Travis County, would be the site of Tesla’s newest factory. The victory for Texas comes at a loss for Oklahoma, which also was seeking to have the factory land in Tulsa. The facility seeks to create as many as 5,000 new jobs. The County offered up to $65 million in tax rebates to entice the company, and plans to begin construction in the third quarter.

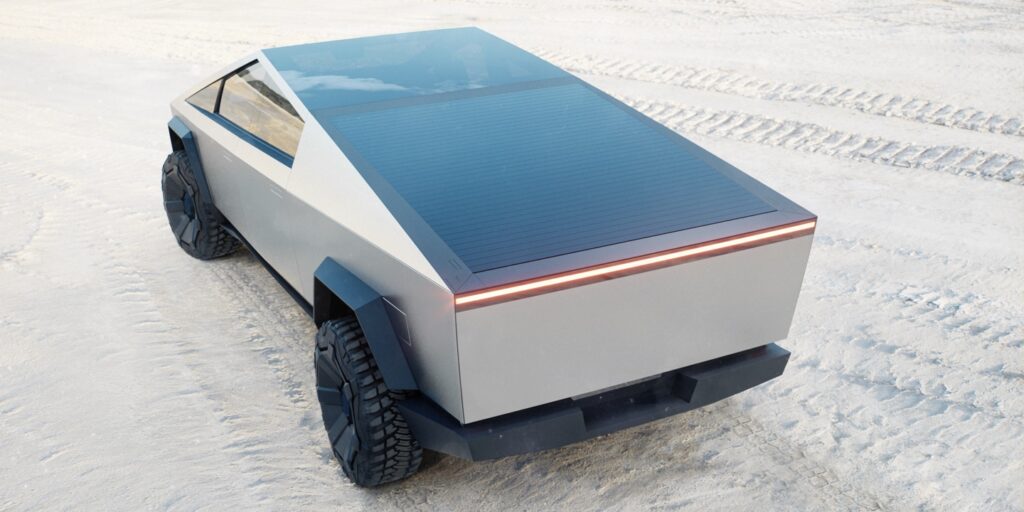

The additional plant is slated to produce Model 3 and Model Y vehicles for the Eastern half of the United States, as well as a potential new Tesla Semi truck and its Cybertruck pickup. Elon Musk has stated that his cars are not affordable enough yet for the average consumer, and he hopes to develop a plan to address that issue.

The company also needs to address its growing need for affordable battery cell production, and is looking to expand its partnerships with Panasonic Corp <PCRFY> and Contemporary Amperex Technology of China (CATL) <300750.SZ>.